Tether Continues Minting Tokens Despite Allegations of Bank Fraud

Since its inception in 2014, the largest stablecoin by market capitalization, Tether (USDT), has been amid controversy regarding the solvency to its claimed 1:1 pegged value to the US Dollar. But is Tether really a stablecoin? A stablecoin is defined as: ‘any digital currency designed to have a relatively stable price, typically through being pegged to a commodity or currency or having its supply regulated by an algorithm.’ As per fulfilling the stablecoin requirements, Tethers website claims that:

Every Tether token is always 100% backed by our reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities (collectively, “reserves”). Every Tether token is also 1-to-1 pegged to the dollar, so 1 USD₮ Token is always valued by Tether at 1 USD.

Given the recent all-time high digital currency total market capitalization, speculators correlate that the price surge is due to an alleged scheme by which Tethers have been issued without any actual US dollar backing. Critics claim the newly minted USDT are used to purchase Bitcoin and other digital currencies. As a result of this claim, there would be an artificial surge in price across all exchanges given the markets perceived notion that 1 USDT is equal to 1 USD. For example: since January 2020 over 60 billion Tethers were minted for a total of a 65 Billion U.S Dollar market capitalization, but is there actually 65 Billion USD in reserves to back all the minted Tethers in circulation?

Regulators called into question a proper audit regarding the ‘reserves’ of the alleged stablecoin. On February 23rd, 2021, New York Attorney General Letitia James released a statement regarding Tether LTD and Bitfinex, (a once US-based exchange which now operates in the British Virgin Island's) where she claimed:

“Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines,” said James. She continued: “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie. These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

Following this statement, the Cayman Islands-based accounting firm Moore Cayman released this document on February 28th, 2021. The document is an ‘opinion piece,’ and not a legal audit. Shortly after the opinion piece was released, Paolo Ardonio, the CTO of Bitfinex and CTO of Tether LTD made the conclusion that the opinion piece meant Tether was ‘fully backed.’ He stated this in a tweet immediately after Tether LTD released the document. Since the piece was released, nearly 30 billion USDT have been issued into circulation without any official audit.

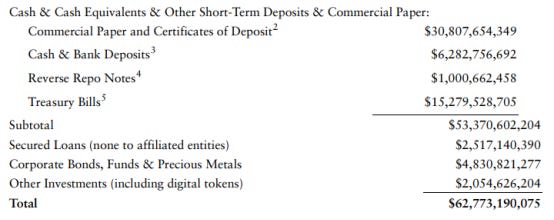

Moore Cayman later released this Independent Accountants Report to illustrate a breakdown of Tethers reserves prior to June 30th, 2021, stating that Tether LTD’s consolidated assets exceed their libilities. Here is the breakdown of Tether LTD’s total consolidated assets:

Given these statistics, Tethers reserves equate to about 50% of commercial paper and less than 10% is in the form of cash and bank deposits. Commercial paper is an unsecured promissory note, having said this, much curiosity was brought to the origin of the commercial paper. In a CNBC interview on July 21 with Tethers LTD’s CTO: Paolo Ardonio and General Council Stuart Hoegner, CNBC’s reporter Deirdre Bosa asked Hoegner about the origin of Tethers commercial paper holdings. Hoegner declined to answer, but rather assured to CNBC that it is all A-rated (Mostly A-1 and A-2) commercial paper (top tier).

Bosa factored in the point that A-rated commercial paper differs in standard from jurisdiction. She argued that US A-rated commercial paper differs in standard from China, or any country. She asked Hoegner if he would share the details as to which country gave Tether LTD’s commercial paper holdings an A-rating. Hoegner declined to answer the question.

After the June 30th Independent Accountants report, Tether minting briefly stopped, with the total supply decreasing around 1 billion in the July period. On July 26th Bloomberg released an article that Tether executives are said to face a US criminal probe into bank fraud. While more is expected to surface on this news, many speculate what will happen to Tether if holders are unable to redeem US dollars for their Tethers. Tether LTD states in their terms and services :

Tether reserves the right to delay the redemption or withdrawal of Tether Tokens if such delay is necessitated by the illiquidity or unavailability or loss of any Reserves held by Tether to back the Tether Tokens, and Tether reserves the right to redeem Tether Tokens by in-kind redemptions of securities and other assets held in the Reserves.

This statement means that if Tether were to lose its 1:1 peg to the US dollar, Tether LTD can delay customer redemption or issue a ‘reserve equivalent’ of redemption. Given that 50% of Tethers reserves are in commercial paper of unknown origins, and 50-60% of the whole digital currency market liquidity is in Tether, analysts at JPMorgan believe that a severe liquidity shock would result if traders were to lose faith in Tether. Therefore, the solvency of Tether is crucial for the fate of the digital currency market.

Written By: Kurt Laengner

If you enjoyed this content, please consider sharing and subscribing to this newsletter for updates.